REITs have long been pioneers in the real estate industry. One of the most significant developments was establishing a corporate governance structure, dividend payouts, and perpetual capital to align the interests of REIT managers and investors effectively.

Additionally, REITs have generally been among the first to introduce institutional capital into new and developing real estate sectors. Self-storage, healthcare, hotels and accommodation, billboards, and lumber are a few of the cutting-edge industries that REITs have pioneered.

When it comes to housing the digital economy in data centers, communications towers, and industrial and logistics facilities, REITs have taken the lead. Technology has been at the forefront of many economic advancements.

By embracing new property types like single-family rentals, cold storage, life science and laboratory space, casinos and gambling, and others, REITs are continuing to innovate.

Access to Capital Leads to Capital Markets Stability

Local real estate markets are becoming more efficient and liquid due to REITs’ integration of the capital and real estate markets. This results in more effective capital allocation.

Real estate investment trusts (REITs) are a useful tool to boost market transparency and give market-based pricing signals to assist and control real estate development more efficiently. This will help to foster stability in the local real estate market. Additionally, REITs can support monetary stability. According to research, REITs prevented a real estate price bubble in commercial real estate in the years leading up to the Great Financial Crisis.

Promoting asset securitization – Asset securitization gives companies a second source of funding and can successfully remove credit risk from bank balance sheets. In addition to supporting property owners and diversifying investment opportunities for all investors, REITs provide a dependable and transparent way to securitize assets and lower systemic risk.

Reducing the real estate sector’s reliance on shadow banking – REITs offer equity funding, and many are required to disclose financial performance information when they trade on stock markets, enhancing transparency and management responsibility.

All local investors, even small ones, will have access to the long-term advantages of investing in real estate for accumulating wealth and securing one’s financial future thanks to REIT-based real estate investment. REITs are being used more frequently by pension funds, endowments, and other institutional investors worldwide as part of their real estate portfolio.

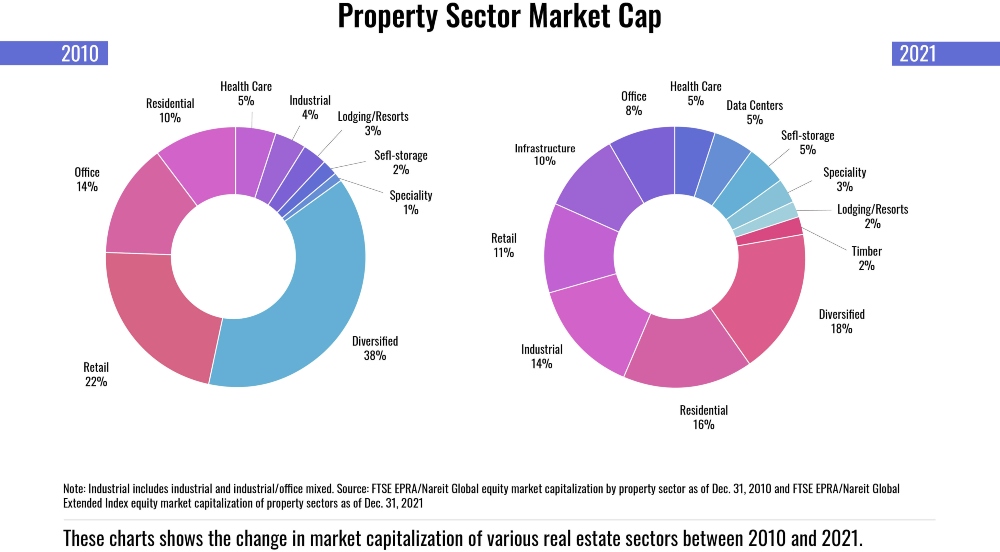

The composition of the REIT stock market capitalization has undergone significant changes over the past ten years as a result of the changing economic climate. In terms of owning and managing the real estate that houses the digital economy, REITs have been at the forefront.

“In 2010, industrial REITs accounted for just 4% of total equity REIT market cap, communication towers had not been introduced into the index series, and data centers were not broken out into a stand-alone sector. In 2021, the infrastructure, data center, and industrial sectors accounted for 30% of the equity REIT market cap. ” (Source: Nareit)

Infrastructure REITs hold the communication towers and fiber used for data and voice transmission, enabling information to move between devices all over the world.

The servers used to connect data communications, store data, and manage the internet are housed in buildings owned by data center REITs.

The cold storage and e-commerce logistics facilities are owned by industrial REITs. In temperature-controlled environments, goods like electronics, perishable groceries (both fresh and frozen), and medical supplies are kept in good condition before delivery.