Our investment strategy is based on creating constant profits for our investors by buying and renting out commercial properties as well as investing in various construction projects.

Serbian Build Fund LLC, a private fund/trust for real estate management, focuses on generating profit through two business segments.

Through acquisitions of commercial buildings, we ensure a constant inflow of funds. With the money we get from renting out commercial buildings in our ownership, we ensure a profit and constant payment to our investors and partners.

Another model of our business is investing or reinvesting the fund’s capital in various projects, with a focus on construction and ESG projects. Our goal will be to invest in modern projects that have the potential for development in the future, namely green infrastructure projects, wind farms, solar power plants, and eco-friendly buildings, as well as self-sustaining development and startup projects in Serbia.

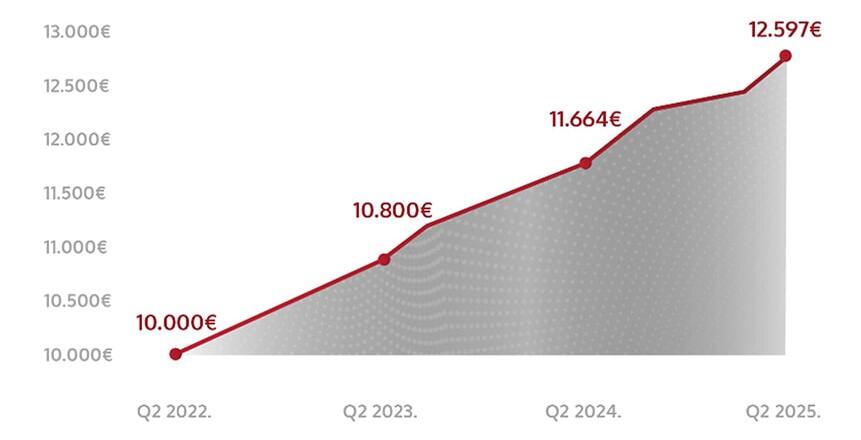

The annual dividend is 10%, with the possibility of a cumulative dividend of 25.97% for 3 years, with fee costs, which makes us the best open investment option in Serbia and the region.

With low commissions and the possibility to reinvest dividends, we create an excellent opportunity for investors with different personal net worth and investment levels.

Management fee expenses will be deducted from the dividend.

Entry and exit commissions do not exist, just as there are no other hidden commissions and costs.

Constant cash flow

Portfolio diversification

Protection against inflation

This chart shows a potential investment of €10,000 and the annual profit with dividend reinvestment after deducting the annual management fee.

Our strategy and our projects are long-term because investing is a marathon, not a 100m race.

SIGN UP FOR THE NEWSLETTER

*By clicking on “Sign up for the newsletter”, I agree that SBF informs me about news and activities via the newsletter.

Website Developed by Executive Digital