Commercial real estate is important to the economy and has a major impact on entire neighborhoods and communities.

Through the diverse array of properties they own, finance, and manage, REITs help provide essential real estate that supports neighborhoods, enables the digital economy, powers essential community services, and builds infrastructure.

By creating jobs, training, and contributing to other areas of their business, such as employment taxes, VAT, and property taxes, REITs are responsible for generating significant amounts of tax revenue, both at the shareholder level where taxes are levied and at the areas of their business.

Through the people they directly employ, the goods and services they buy from others, the structures they create, build and buy from others, and the dividends and interest they pay to investors, the economic activity of REITs support employment and economic growth. Among others, REITs employ analysts, asset managers, sustainability managers, and human resources specialists.

REITs that manage their own properties may also directly employ staff in maintenance, custodial, hospitality, and other positions.

For example, in the US in 2020, REITs supported approximately 2.9 million full-time jobs, directly employing 308,000 full-time equivalent employees.

In addition to supporting job creation, many REITs have launched social programs; these focus on job training and career development in their sectors to help their clients build talent pipelines while strengthening career paths and creating economic opportunities in the communities where they work.

ESG – Environmental Stewardship, Social Responsibility, and Good Governance

REITs and their stakeholders are increasingly recognizing the importance of ESG models.

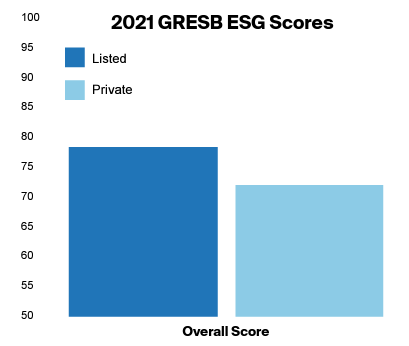

Real estate managed by REITs outperformed privately managed real estate in all three ESG categories and by six points overall, as shown in the table above. (GRESB)

REITs understand that they contribute to and affect meaningful change in their communities, regions, and countries through the ESG activities they undertake and the metrics they establish, report, and achieve.

Environmental Stewardship

Environmental stewardship has long been a focus area for the REIT industry, with investments in energy-saving and waste-reducing technology, sustainable building materials, and responsible environmental management processes prioritized by much of the industry.

In recent years, many REITs have begun tracking the impact of environmental activities. They have found that significant cost savings, solid tenant and community engagement, strong executive and board commitment, and effective risk management are some of the consistent value-added benefits.

Social Responsibility

The REIT industry has been increasingly focused on its social responsibility standards as developers, owners, and operators of the built spaces that the full range of communities and societies use every day. Numerous innovative partnerships and initiatives have been established to address customer demands, involve employees, and advance community well-being. To advance diversity, equity, and inclusion in the REIT and real estate investment industry, there is still much to be done in terms of effective, transparent reporting and community engagement.

Good Governance

REITs have a long history of good governance practices. In many global REIT regimes, by law, REITs must distribute most of their taxable income.

Because there is limited opportunity to retain earnings, management is more likely to be efficient with available funds, shareholders have greater control over earnings, and management objectives align with shareholder interests.

Public REITs, as opposed to private real estate investments, are only able to raise additional funds in the public capital markets by being transparent with investors about their financials and disclosing significant business developments and risks.

This enables investors to research and value REIT stocks independently.

Such an examination offers some protection and multiple indicators of REIT’s financial health. Additionally, compliance with the securities rules of a specific nation or region frequently necessitates regular public disclosures, such as quarterly and annual financial reports.

When we consider all these segments and data, REIT as a business model greatly benefits society, communities, and the environment.