REITs are a cheap, efficient, and liquid way to invest in commercial real estate, which is a fundamental asset class. The purchase of REITs aids in the development of diverse portfolios that span the whole spectrum of investment markets. Historically, commercial real estate has added special qualities to a portfolio, such as:

- A distinct economic cycle relative to most other stocks and bonds,

- Potential inflation protection, and

- Reliable income returns.

Historically, REITs have produced competitive total returns supported by strong, dependable dividend income and long-term capital growth.

They also make a great portfolio diversifier because of their very low connection with other assets, which can lower total portfolio risk and boost profits.

The growth in size and importance of real estate, primarily equity REITs, resulted in a new real estate sector classification by S&P Dow Jones Indices and MSCI in their Global Industry Classification Standard (GICS®) in 2016. Similarly, in 2019, FTSE Russell added the real estate sector within its Industry Classification Benchmark (ICB®).

These classifications urge real estate — especially REITs —to be more actively considered when creating investment plans and portfolios by investors, managers, and advisors.

Characteristics of REIT-Based Real Estate Investment

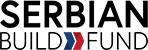

“As the chart shows, global listed real estate, including REITs, has generally outperformed global stocks and global bonds over the long term. The compound annual growth rate in returns from February 2005 to December 2021 is 6.9% for the FTSE EPRA/Nareit Global Index, compared with 5.8% for the broader global stock market (represented by MSCI EAFE), 5.4% for private real estate (NCREIF’s Global Real Estate Index through September 2021), and 3.1% for global bonds (Bloomberg Barclays Global-Aggregate bond index). Within global real estate, REITs have outperformed other listed real estate companies. From June 2009, the average annual growth for the FTSE EPRA/Nareit Global REITs Extended Index was 13.0% during that same period.

As of Dec. 31, 2021, the FTSE EPRA/ Nareit Global Extended Index, the broadest global stock exchange-listed REITs and property companies in developed and emerging countries and regions, included 537 constituents with a combined float-adjusted equity market capitalization of $2.6 trillion. REITs represented 83% of that market capitalization. “

Source- Nareit

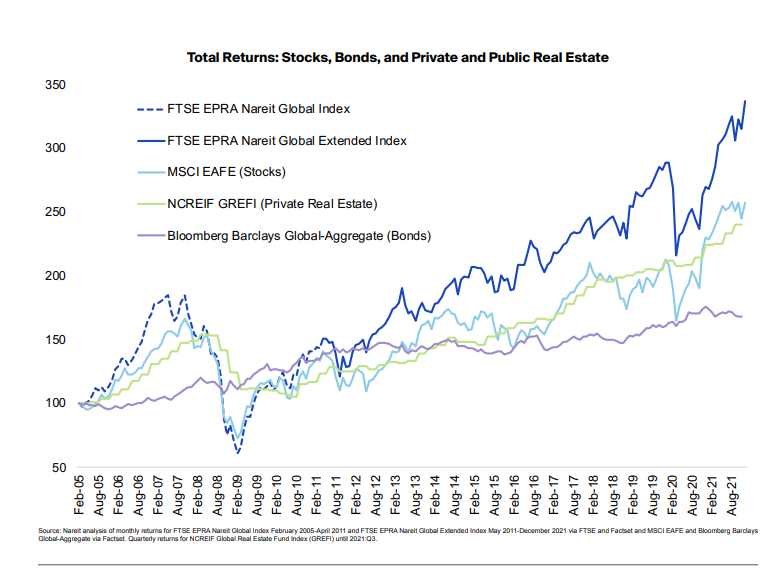

Diversification – The FTSE EPRA/Nareit Global REITs Extended Index has a 0.79 correlation with MSCI EAFE, indicating that REITs have a low correlation with other equities and bonds.

Assets have gotten more connected during the last few decades.

Fortunately, real options for diversification are accessible through REITs.

The low correlation that REITs have had with the whole stock market is shown in the chart in the next illustration.

Liquidity — REITs are bought and sold like other stocks, mutual funds, and ETFs.

Dividends — REITs have provided reliable income returns.

The dividend yield for the FTSE EPRA/Nareit Global REITs Index for Dec. 31, 2021 was 3.15 versus 2.51 for MSCI EAFE.

Inflation Protection — Due in part to the fact that many leases are tied to inflation and that real estate values have tended to increase in response to rising replacement costs, REITs have provided natural protection against inflation, and their dividends delivered a reliable stream of income even during inflationary periods.

The REIT strategy for real estate investments fosters local economies, increases global investment, and benefits communities. REIT investors can create diversified real estate portfolios across various property types and geographies.

REITs enable access to international investment money, facilitate widespread domestic commercial real estate ownership, and support the development and investment in commercial real estate and infrastructure.