Serbian Build Fund LLC, as a private fund, gives investors the opportunity to profit from the real estate market worldwide, Serbia included. The vision of the Serbian Build Fund is to create an opportunity for Serbs from all over the world to invest in the growing real estate market and profit from it.

The team leading Serbian Build Fund LLC is a group of experts who have experience in the real estate sector since 2004 and have completed two large projects in the US (Doral CityPlace – Miami and Johnson Ranch – Arizona).

When we take into account the fact that 889.5 million euros were invested in residential buildings in Serbia just in Q1, which is 57% of the total invested money, it is only logical that we want to be a part of that. Therefore, we have decided that the first 3 projects for the next three years will be projects under construction, mostly residential buildings.

As investors, you will place your money through Serbian Build Fund LLC in our partner’s Miami Constructions Pros projects in Kragujevac (CityPlace), Zrenjanin (CityScape), and Subotica (CityDistrict).

Before we start collecting investments, we believe it is very important to explain what the whole process and our business look like to potential investors.

The process is quite simple; the investor invests money through an ownership share agreement with a pre-emptive right to purchase Serbian Build Fund LLC within a 3-year period.

For that period of 3 years, the investor receives a 10% dividend each year, 2% of which goes to the annual management fee; therefore, the investor receives an 8% dividend on an annual basis. However, if the investor does not want to collect their annual dividend, they have the option of collecting the dividend in the second or third year through interest/dividend compounding.

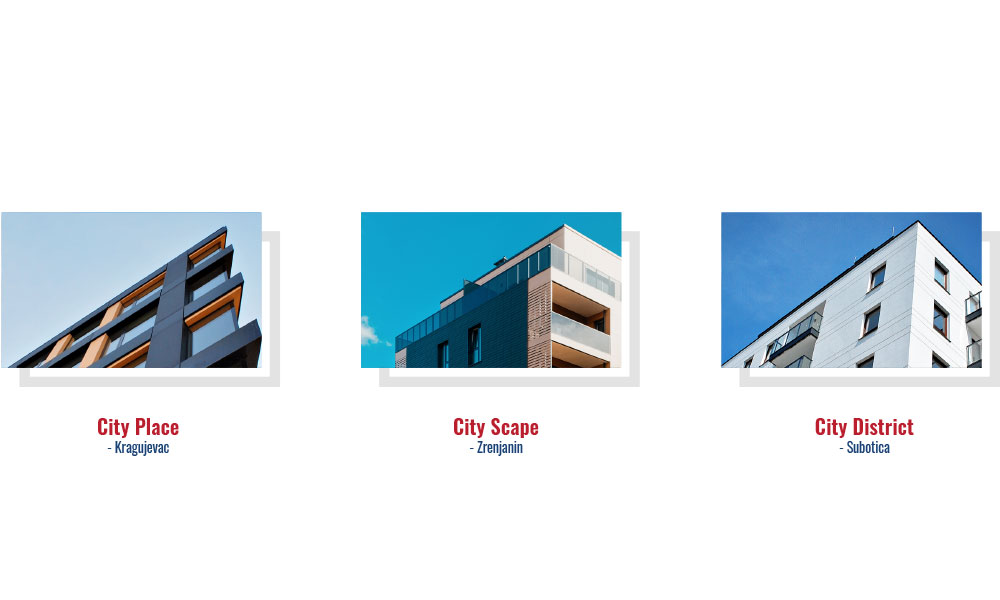

Compound interest refers to the fact that the investor does not want to collect their dividends for the first and second years and that in the third year, instead of 24%, they get 25.97% profit through dividends.

The graph shows a hypothetical investment of €10,000.

A hypothetical €10,000 investment with a dividend reinvestment plan.

This graph shows a potential investment of €10,000 and the annual profit with dividend reinvestment after deducting the annual management fee.

If the investor wants to collect the money before the 3-year period defined by the contract has passed, they can do so under certain conditions with penalties.

Earlier collection with penalties:

- After 18 months (50% of invested money) with a penalty of 5%

- After 24 months (75% of invested money) with a penalty of 3%

When, for example, an investor collects 50% of their invested funds after 18 months, the rest of their money (another 50% that remained in the fund) continues to accumulate dividends on an annual basis.

Also, it is important to note that if the investor sends a request for the collection of funds at a certain moment, they cannot get their money back immediately but after the period defined in the contract (one month).

The money managed by Serbian Build Fund LLC is invested in the projects we mentioned earlier, and the expected return of money (10%) is paid to the investors through dividends.

Serbian Build Fund LLC plays the role of a mezzanine financier, i.e., a second-tier creditor, and after the projects are completed, and the part claimed by the bank is paid, SBF gets its profit. SBF does not participate in the construction and sale of buildings but only finances them.

After a period of 3 years, investors receive their initial investment and their profit, depending on whether they chose the interest/dividend compounding option or collected their dividend year after year.

It is very important to note that by purchasing an ownership share in Serbian Build Fund LLC, that is, an American private fund registered and regulated by the SEC and the IRS, the investor does not have the right to make decisions related to the placement of the fund’s money; the board is responsible for that, which is also the asset management of the fund itself.