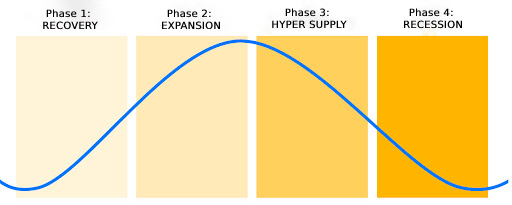

The real estate market cycle is a four-phase pattern through which the commercial and other real estate markets move. The four phases of the real estate cycle are recovery, expansion, hyper supply, and recession.

Understanding the real estate cycle can help you predict upcoming trends and make better decisions about your investments, whether you’re a real estate buyer, renter, real estate seller, landlord, real estate agent, or real estate investor.

In this article, we will discuss the 4 phases of the real estate market cycle.

Phase 1: RECOVERY

While the recovery phase is often cited as the first phase, the real estate cycle is circular, meaning that the recovery phase occurs after the recession phase, when demand is slow but rising.

This phase is characterized by low absorption rates, very few houses under construction, high (but declining) work vacancy rates, and slow price growth. A recovery phase can be challenging to distinguish from a recession phase because the market will look almost the same, but the market conditions will still experience a small shift in momentum.

Housing prices are slowly rising as real estate purchases increase and the economy recovers from the recession.

The recovery phase is a popular time for real estate investment and speculation because real estate prices are low, while the potential returns from renting or reselling are quite high. This phase begins in a buyer’s market and ends in a seller’s market.

Phase 2: EXPANSION

In the expansion phase, the real estate market has fully recovered from the recession phase; the economy is growing at full strength, unemployment has dropped significantly, and construction rates are increasing. Also, customer demand is on the rise, and consumer trust is increasing.

When the real estate market expands, work vacancies decrease, rental rates are high and rising, property values grow, and new construction is typical.

This is a very good time for real estate investors to buy new rental properties or renovate old buildings since the demand is high and new tenants are usually very easy to find.

Phase 3: HYPER SUPPLY

In this phase (also called the oversupply phase), the supply will finally catch up and exceed the high demand as previously started construction projects continue and get completed. Work vacancies will increase again, and the leases will slow down.

During this phase, some investors will buy real estate from companies that are unstable and uncertain due to the impending recession and are eager to sell their facilities at a currently more attractive price. These investors will then wait until the last phase, the expansion phase, to sell their investments.

Another common investment strategy is to invest in a building with existing tenants that is at full capacity and has long-term leases because such properties will continue to bring steady cash flow during the coming recession.

This phase is often the most difficult to predict. The low interest of buyers and the increasing number of real estate sale ads indicate that the market is in this phase.

Phase 4: RECESSION

Recession is characterized by a strong “buyer’s market.” Supply is significantly higher than demand, and prices are falling. If you plan well and invest strategically, buying real estate in this period can provide you with lifelong income and profits.

Rent growth is typically negative or below the inflation rate, causing many investors to resort to concessions or rent reductions to retain tenants and clients. It is important to note that if you buy real estate in this period, you should not expect a quick return of money and earnings.

Recognizing when the price drop is slowing down and when it’s time for recovery is what makes the difference regarding good money management and investing for the future.

These cycles are important to understand in order to make the right decision about your investments related to the real estate market. The first and second phases have similar characteristics – growth and then decline – which are mostly triggered by the same drivers. However, the scope of the change and the length of the cycle do not repeat at the same time; that is, they cannot be determined with accuracy.

With this knowledge and information, you can make a better decision about the direction that the prices are likely to take.

Still, before you invest your money, be sure to consult an expert you can trust about what phase of the cycle we are in and how long that phase will last.

Also, your decisions regarding the purchase of real estate depend on whether you will use the real estate as a home or try to make a profit from the invested money.