REIT as an investment option has experienced a global expansion; therefore, investing in REIT is entirely normalized in many countries, like investing in individual stocks of public companies or government bonds.

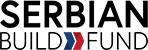

The US REIT business strategy for real estate investing has been adopted by more than 40 countries and regions, giving all investors access to a global portfolio of income-producing properties.

The simplest and most effective approach for investors to include global real estate allocations in their portfolio is through mutual and exchange-traded funds. In addition, there is also investing in specific real estate sectors as well as in specific real estate markets in certain regions and countries.

How many REITs are there in the world?

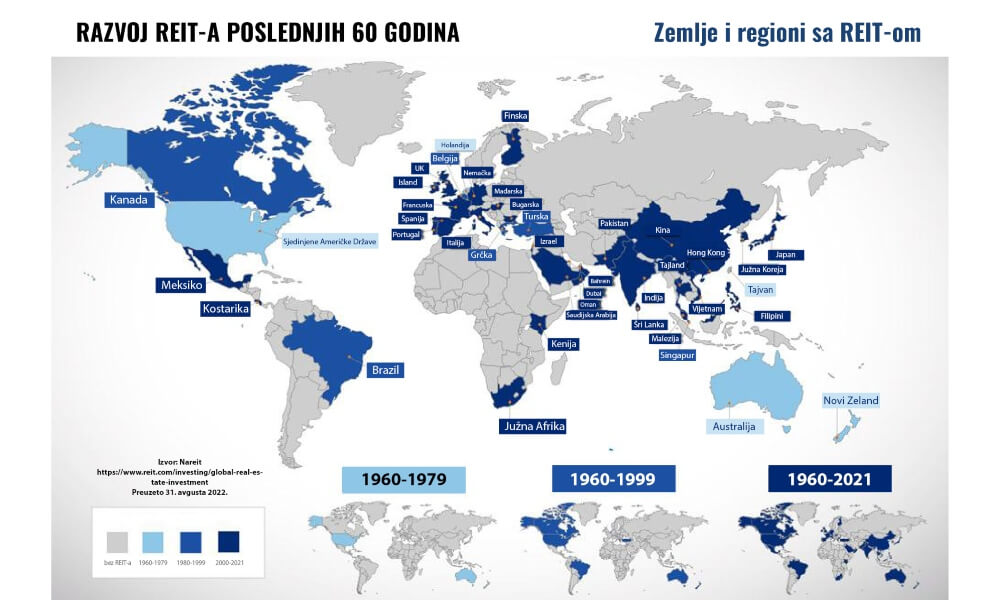

As of December 2021, 865 registered REITs were operating globally, with a combined market capitalization of approximately $2.5 trillion. The following charts show how REITs have grown significantly over the past 30 years in terms of number and market capitalization, from 120 listed REITs in two countries to 865 in more than 40 countries and regions.

The number of listed mortgage and property REITs from the FTSE Nareit All REITs Index, as well as companies listed on the S&P Global Capital IQ in REIT countries and regions.

Asia is pushing hard for REITs, increasing from 31 REITs in six countries and regions in 2005 to 216 REITs in 11 countries and regions in 2021. Of course, this is also happening because of the significant expansion in the real estate sector. The Middle East has also seen considerable growth since 2015 with the addition of REITs in Saudi Arabia and Oman.

The date marks the year when the REIT rules were adopted

How much global GDP and population do countries and regions with REITs represent?

The market capitalization of REITs has gradually increased worldwide, with North America experiencing the most significant growth, from $8.7 billion in 1990 to $1.8 trillion in 2021. This expansion demonstrates the success and persistence of the REIT strategy. As the REIT concept has become popular worldwide, countries and areas with REITs accounted for 85% of global GDP in 2020, up from 28% in 1990. During this time, the GDP of REIT countries and regions grew from $6.5 billion to nearly $72 trillion.

In 1990, REIT countries and regions accounted for only 6% of the global population; that number grew to 64% of the world’s population in 2020. Asia has fueled population growth for REIT countries and regions, particularly with the adoption of REITs in India in 2014 and China in 2021.

REIT as an investment concept and strategy is unstoppably growing and spreading worldwide. Interestingly, people in the Balkans still need to see traditional investing as an investment and profit potential. That problem entails an issue with investing in REITs in general.

With more education and spreading awareness, Balkan people will hopefully also take the opportunity to become part of the prominent real estate market by investing in REITs. We at Serbian Build Fund are working on precisely this, and we believe that REIT will be a widely used form of investment both in Serbia and throughout the Balkans very soon.

Interestingly, over 80% of financial advisors and investment management firms recommend REITs as an investment. Leading investment management firms — including BlackRock®, Fidelity®, and State Street Global Advisors® offer REIT-focused products.

REITs are truly a global opportunity to invest in and profit from the real estate market and sector.