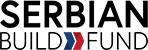

Economic growth, investor diversification, and community development are all bolstered by real estate investment trusts (REITs). Any property held by a REIT can alter the character of a whole neighborhood. As a sector, REITs provide considerable gains to the economy, employment, and social well-being.

About $4.5 trillion is owned in gross real estate assets by REITs; over $3 trillion is held by publicly listed and non-listed REITs; the rest is held by privately held REITs. Those assets have a far-reaching economic and investment impact, touching the lives of millions of people across the United States.

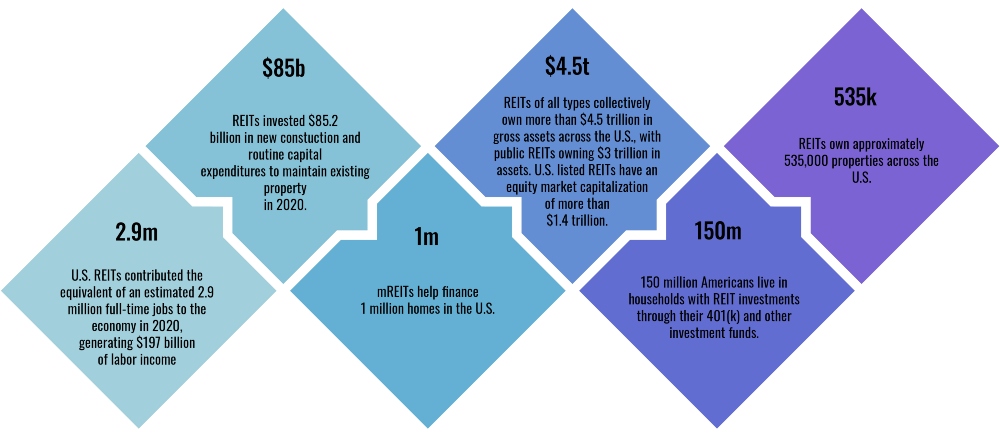

REITs have expanded in size, significance, and popularity since their establishment in 1960. REITs are becoming increasingly significant in the equities market, as evidenced by the development of prominent real estate sectors dominated by REITs in key industry classification standards.

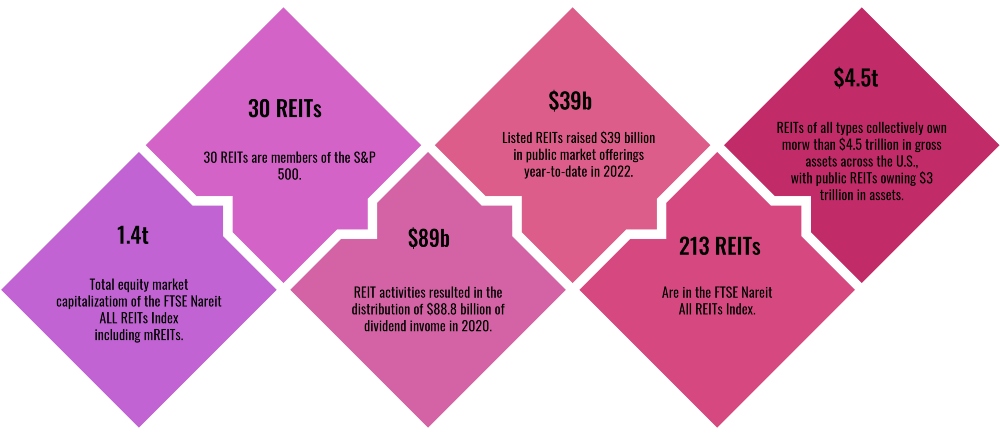

The returns from REITs have been consistently high throughout the years. Due to the industry’s proven track record, it has gained greater acceptability from financial advisors, retail investors, and institutional investors.

*Data as of September 2022, unless otherwise noted, taken from Reit.com