Real estate REITs, which invest in all kinds of commercial and other types of real estate, have been paying investors quite well in recent years.

The REIT industry has undergone significant changes compared to just two years ago. Market volatility and significant suffering were caused by the pandemic and the economic shutdown that followed.

Initial investment costs increased, dividends were cut, and stock prices collapsed. Valuations are at 10-year lows, and many REITs offer generational buying opportunities.

Here are four important facts you should know about REITs to maximize your investment.

1. Investing in a REIT is not the same as buying real estate

REITs are not like traditional real estate ownership, even though they are based on it. Similar to a specialty mutual (investment) fund, a REIT can invest in a wide range of businesses that develop, acquire, and manage commercial and other real estate types.

The Securities and Exchange Commission has registered more than 300 such funds in the United States, while REITs own more than 40,000 commercial buildings.

You can invest in retail properties, office buildings, residential properties, hospitals, dormitories, farmland, parking garages, industrial properties, and a variety of other types of real estate that often turn a profit when managed effectively through REITs.

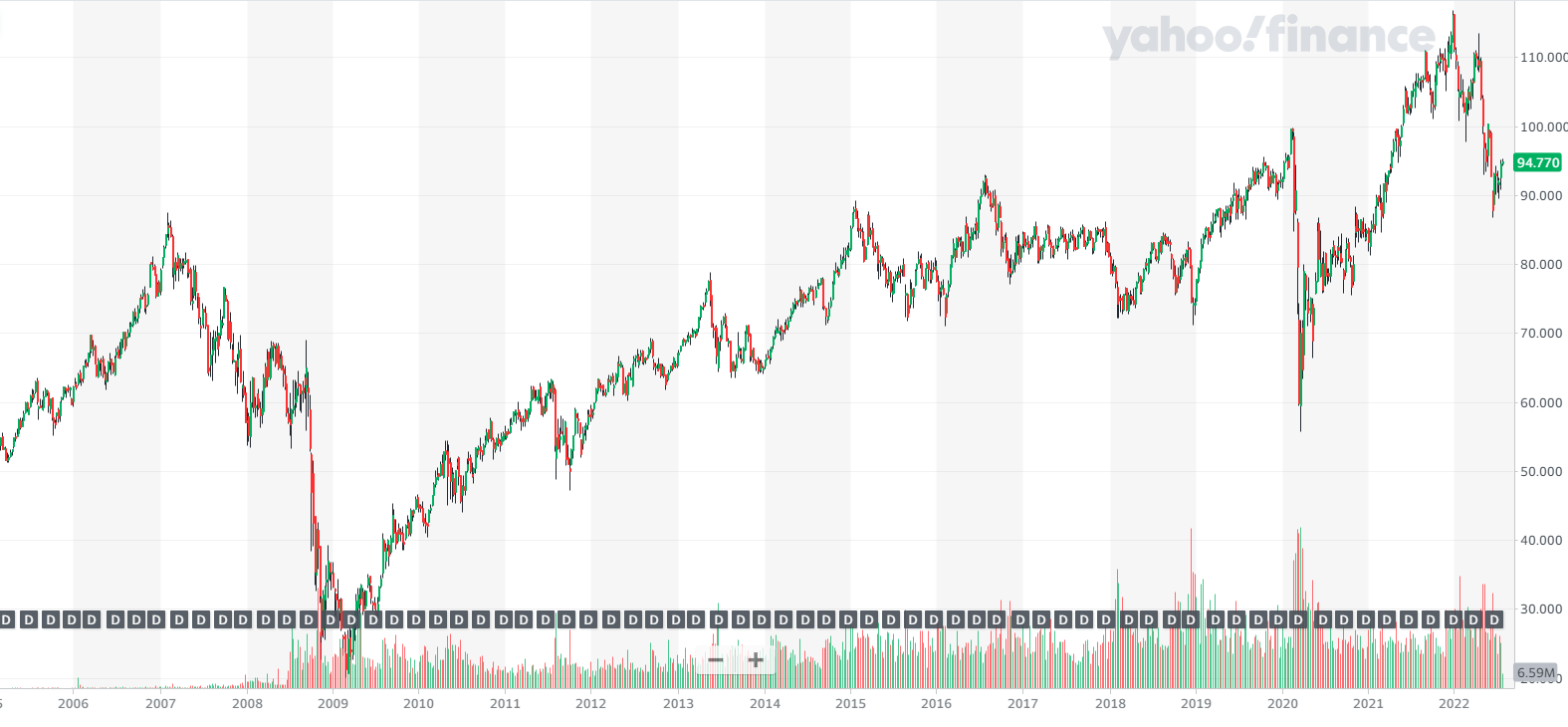

2. REITs have always made a full recovery

Remember that patience pays off in real estate investing before you panic and sell your REITs. REIT stock values have fallen dramatically during numerous crises. However, they always made a full recovery.

That involves a 100% recovery success rate over many years. In addition, REITs have been through significantly worse crises than the current one.

For example, in 2008-2009, REITs had overstretched balance sheets as they entered the sharpest real estate downturn ever recorded. Banks went out of business at the worst possible time, forcing REITs to issue equity at bargain prices to survive. That crisis truly affected REITs and called the whole sector into question.

3. Diversification and reduction of portfolio volatility

While their long-term returns are similar to the S&P 500 and US large-cap stocks, REITs seem tailor-made for portfolio diversification. From 1975 to 2006, a portfolio split 50/50 between the S&P 500 and the REIT index had a 15.2% return versus 13.5% for the S&P 500 alone. What’s more, the risk was 12% lower than with S&P 500 alone.

Most of the time, there are other motivations for owning a REIT than increasing your portfolio’s returns. The main reasons are the reduction of volatility, the expansion of diversity, and the offer to place money.

How do REITs reduce volatility? The answer is in the results that are often very different from those of other important types of investment funds. Since 1975, REIT returns have deviated from the S&P 500 by 25 percentage points or more in about one out of four years. REIT returns were higher during most of those years.

4. Not all REITs are publicly traded

You can learn all about the different REIT types in one of our previous blogs.

When discussing how to invest in REITs, we have to mention that not all REITs are public, meaning they are not traded on stock exchanges.

Thus we have 3 types of REIT funds:

Publicly traded REITs

Shares of publicly traded REITs are listed on stock exchanges, where they are bought and sold by individual investors, funds, and institutions. They are regulated by the US Securities and Exchange Commission (SEC).

Public non-traded REITs

These REITs are also registered with the SEC but not traded on national stock exchanges. As a result, they are less liquid than publicly traded REITs. However, they tend to be more stable because they are not subject to market fluctuations.

Private REITs

These REITs are not required to be registered with the SEC and are not traded on stock exchanges. Generally, private REITs can only be sold to institutional investors. However, the operations of a private REIT fund depend on its business policy and the prospectus of the fund itself.

When it comes to Serbian Build Fund LLC, you can find information for investors, i.e., the fund prospectus, here.